Invoice Factoring Fundamentals Explained

Table of ContentsSome Of Invoice FactoringThe Best Guide To Invoice FactoringTop Guidelines Of Invoice Factoring

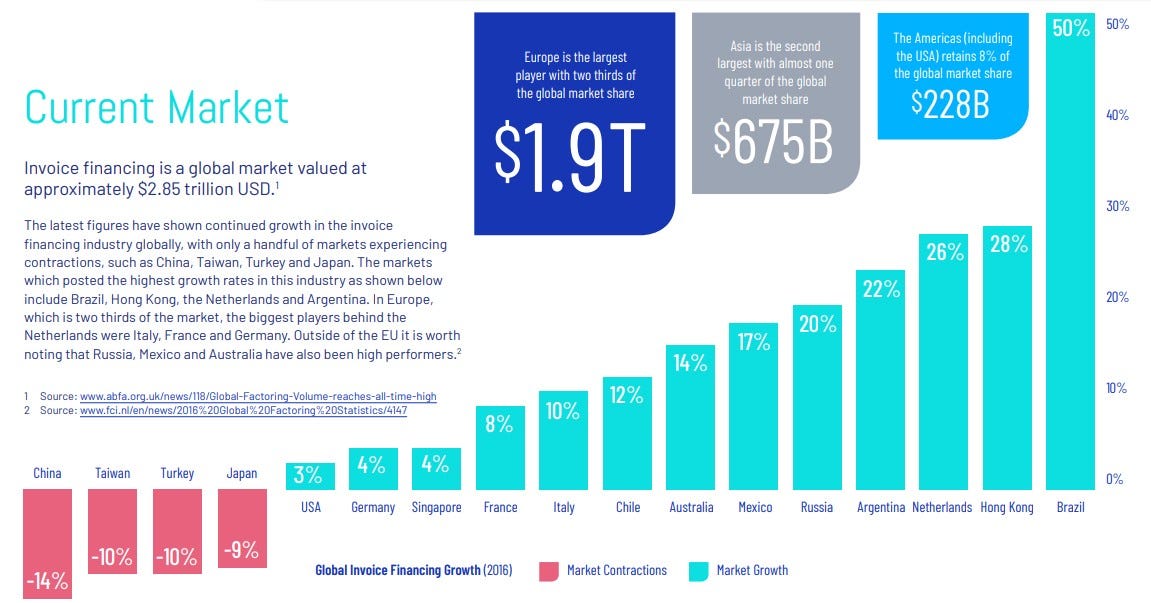

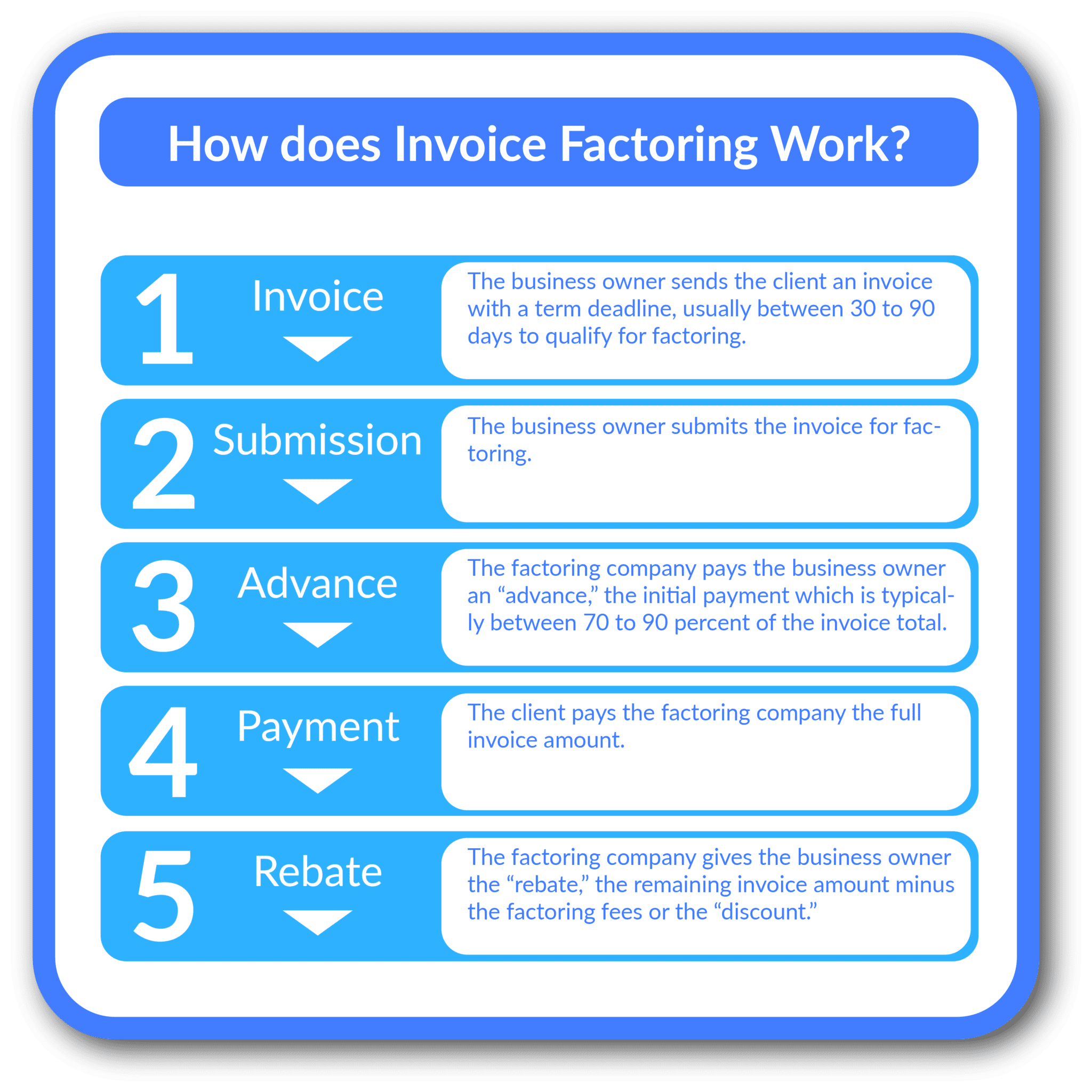

The very first instalment the factoring advance covers concerning 80% of the receivable (this amount differs). The remaining 20%, much less the factoring charge, is rebated as quickly as your client pays the invoice completely. Right here are the steps: You submit the billings for purchasingThe factoring firm sends you the development (e.g., 80% of the invoice) Your customer pays 30 to 120 days laterThe factoring firm sends you the discount (e.g., 20%, much less the fee) Summary Whilst the specific proportion can differ, it's normally performed in two stages.Invoice financing is the usual terminology for the entire accounts- receivable financing sector. Factoring and also discounting are for that reason types of asset-based funding, covered by the umbrella term 'billing money' and also they both share typical concepts. The vital distinction in between invoice factoring as well as discounting is that while billing discounting allows business to maintain control of its sales ledger and invoice collection, factoring gives the billing financing supplier that function.

Some organizations might be worried about the element taking over the credit history control for their company journal, because of the connections with their customers and consumers. Some factoring firms will have really little call with your debtors as well as can in some instances, offer a service to establish up a different savings account which they assume control of, and also that is under your business name.

Some Of Invoice Factoring

Choice factoring is standard method, unless otherwise defined, suggesting if your customer does not pay it becomes your obligation to cover the expense. Non-recourse factoring is a particular product in it's own right and is often referred to by lending institutions as 'negative financial obligation protection'. Uncollectable loan protection safeguards your company from non-payment.

The billing money market is not currently controlled by the Financial Conduct Authority (FCA). With this in mind you need to work out due diligence with any service provider you may pick, checking out the opportunity of hidden costs which might not be right away apparent. It deserves explaining that policy, must it develop in the future, would probably increase the expenses of factoring (invoice factoring).

We have a number of options to look for factoring solutions, whether you are wanting to factor your organization' invoices selectively, or you need a factoring center to access funds, recurring. If you assume your service may gain from a billing funding please do not hesitate to either see this site use our cost-free invoice money platform (listed below) that offers you accessibility to the whole market, complete the fast quote kind towards the top of this web page, or simply send us an email.

Little Known Questions About Invoice Factoring.

Find out more information concerning how factoring deal with the Business Professional site. Many of the well known financial institutions do supply factoring although some are very careful concerning taking on customers beyond their existing organization consumers. Usage Business Specialist's cost-free quote solution to get quotes from a series of the leading lenders.

Invoice factoring is a way for organizations to raise cash by offering billings to a factoring company at a price cut. Factoring typically consists of credit score control solutions, as well as aids firms release cash i thought about this from their borrower publication. Here's every little thing you need to learn about billing factoring. Billing factoring is a form of invoice financing, designed for businesses that invoice their consumers and obtain payment on terms.

Joe's Company requires assist with cash money flow and consents to a factoring center with a lending institution. The advance percentage in Joe's contract with The Billing Business is 80%, so when Joe raises an invoice worth 10,000 and also submits it online, The Billing Business breakthroughs Joe 8,000. invoice factoring. As we've spoken about, one potential benefit of factoring is credit score control, so if the consumer was late paying what they owed Joe, The Invoice Firm would contact them on his behalf and remind them the bill was past due.